CONSIDER INVESTING IN COLOURED GEMSTONES

THE SPARKLE OF OPPORTUNITY

CONSIDER INVESTING IN COLOURED GEMSTONES

In the world of investments, traditional options like stocks and real estate have always held sway. However, as markets evolve and diversify, alternative investment opportunities are gaining traction.

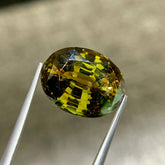

One such option that has been capturing the attention of savvy investors is investing in colored gemstones. Beyond their intrinsic beauty, colored gemstones have become a viable option for those seeking to diversify their portfolios and potentially earn substantial returns.

In this article, we will delve into the world of colored gemstone investments, exploring their appeal, factors to consider, and risks involved. Colored gemstones are becoming the preferred choice for smart investors and those seeking unique engagement rings. The ring, once the norm for proposing to a fiancé, is now seen as passé and predictable. Traditionally, jewelry has been cherished as a personal treasure rather than an investment. It serves as a special adornment that brings joy to the wearer, often passed down through generations to be cherished by heirs and loved ones. These pieces, like a beautiful necklace or elegant earrings worn during festive occasions, hold sentimental value and are envisioned to be cherished by future generations within the family.

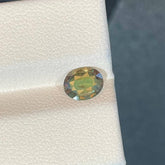

Investing in loose gemstones presents an alluring opportunity for diversification and potential value appreciation. Rare and high-quality gemstones, such as natural sapphires, emeralds, and rubies hold intrinsic beauty and scarcity, making them sought after by collectors and investors. With a track record of long-term value appreciation, loose gemstones offer a tangible and portable asset that can serve as a unique addition to an investment portfolio, combining the allure of precious stones with the potential for financial gain.

Why Consider Colored Gemstones?

- Rarity and Exclusivity: Colored gemstones, such as emeralds, rubies, and sapphires, are inherently rare compared to diamonds. Their limited supply enhances their value over time.

- Tangible Assets: Gemstones offer a unique advantage as tangible assets. Unlike stocks or bonds, you can physically possess and enjoy them, regardless of their investment potential.

- Hedge Against Inflation: Tangible assets like gemstones can act as a hedge against inflation. As the cost of living rises, the value of these precious stones may also increase.

- Demand from Emerging Markets: Growing economies, especially in Asia, have resulted in an increasing demand for colored gemstones, potentially boosting their value.

Why You Should Consider Investing in Colored Gemstones

Investing in colored gemstones presents an enticing opportunity to diversify your portfolio, leveraging their timeless appeal, rarity, and tangible nature as portable assets. They can serve as a potential hedge against inflation, boasting low correlation to traditional markets. The rising demand from emerging economies further enhances their investment allure, while customization options allow for curated collections.

However, it's vital to exercise caution, considering market volatility, authentication challenges, and illiquidity, necessitating expertise and informed decision-making. With thorough research and guidance, colored gemstones can add both elegance and value to your investment strategy. Unlike conventional investments, colored gemstones offer a more enjoyable approach to investing, with relatively less severe declines during recessions and potential for increased value as investors seek alternative stores of wealth. Their small size and portability offer practicality, and the added advantage of wearing these stones beautifully makes them a compelling and astute investment choice. Ready to explore the world of colored gemstone investments? Visit our site.

How Gemstones Offer Stability Amidst Global Inflation.

In an era of economic volatility and currency fluctuations, safeguarding wealth becomes a top priority for investors seeking stability and security. While traditional currencies are susceptible to erosion through inflation and economic uncertainties, investing in gemstones emerges as a compelling solution to preserve the value of wealth over time. Gemstones, such as diamonds, emeralds, and sapphires, possess unique qualities that make them an attractive hedge against currency decline.

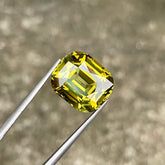

Unlike fiat currencies, which can be printed and devalued by governments, gemstones derive their value from their inherent rarity and beauty. Formed over millions of years, gemstones are limited in supply, making them highly sought after by collectors, investors, and jewelry enthusiasts worldwide.

As demand remains steady, gemstones maintain their worth and offer a reliable means to protect against currency devaluation. Gemstones have a universal allure that transcends borders, cultures, and economic conditions. Irrespective of economic shifts in individual countries, the demand for precious gemstones remains robust worldwide. This global appeal ensures that gemstones can be traded and sold in various international markets, providing investors with a portable and easily transferable asset. Gemstones serve as tangible assets that can be held, admired, and enjoyed, unlike intangible financial instruments vulnerable to market fluctuations. In times of currency devaluation, gemstones offer a sense of security as a physical store of wealth that retains its allure and value, irrespective of economic conditions.

The gemstone market is witnessing remarkable growth with increasing demand attributed to several key factors. Rising affluence and growing disposable incomes in various economies, particularly in Asia, have spurred consumers to invest in luxury items, including gemstone jewelry. Modern consumers' preferences have shifted towards personalized and unique pieces, drawing them to the diverse range of colors and varieties that gemstones offer. Moreover, the influence of celebrities showcasing stunning gemstone jewelry and the power of social media have further fueled the surge in the gemstone market's popularity, making it a thriving and vibrant industry.

How has Gemstone become a trend?

The trend of using gemstones as adornments and talismans dates back thousands of years and has evolved through different cultures and civilizations. The fascination with gemstones can be traced to ancient times, where these precious stones were not only valued for their aesthetic beauty but also believed to possess mystical and healing powers, click here to find out more.

Ancient Civilizations:

The history of gemstones can be traced to ancient civilizations such as the Egyptians, Greeks, Romans, and Mesopotamians. These cultures regarded gemstones as symbols of power, wealth, and protection. Gemstones were incorporated into jewelry, crowns, and religious artifacts, adorning royalty and nobility. They were also used as amulets and talismans to ward off evil spirits and bring good fortune.

Renaissance and Baroque Periods:

During the Renaissance and Baroque periods, gemstones continued to be highly prized by the elite and the wealthy. The period saw the rise of skilled gem cutters, who unlocked the brilliance and beauty of gemstones through innovative faceting techniques. Royal courts and wealthy families commissioned elaborate and intricate gemstone jewelry, showcasing the craftsmanship and the rarity of these stones.

Victorian Era:

In the Victorian era, sentimentality and symbolism played a significant role in jewelry design. Queen Victoria's love for jewelry, particularly pieces with sentimental meanings, influenced the styles of the time. Lockets, rings, and bracelets were adorned with gemstones and personalized with birthstones, initials, or hidden messages. Mourning jewelry, incorporating black gemstones like jet or onyx, became popular after the death of Prince Albert, Queen Victoria's husband.

Art Nouveau and Art Deco Periods:

The late 19th and early 20th centuries brought about artistic movements that influenced jewelry design. Art Nouveau embraced organic and flowing forms, often featuring gemstones like pearls, opals, and moonstones. Art Deco, on the other hand, showcased geometric shapes and bold colors, using gemstones like diamonds, emeralds, and rubies. These periods further expanded the variety of gemstones used in jewelry and introduced innovative designs.

Modern Times:

In the 20th century, advancements in gemology, cutting techniques, and global trade significantly influenced the gemstone market. The discovery of new gemstone sources in different parts of the world brought an array of gemstones to the market. Alongside traditional diamonds, rubies, and sapphires, gemstones like tanzanite, tourmaline, and aquamarine gained popularity.

Gemstones in Contemporary Fashion:

In the contemporary world, the trend of using gemstones in jewelry continues to evolve. Designer brands and artisans experiment with unconventional gemstone cuts and combinations, catering to individual tastes and preferences. Customization has become a hallmark of modern jewelry design, with gemstones being set in various metals and settings to create unique pieces.

How to Invest in Gemstones

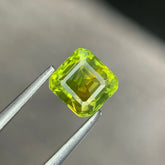

- Educate Yourself on Gemstones: Begin your gemstone investment journey by immersing yourself in the world of gemstones. Learn about the various types of gemstones available, their unique characteristics, and how they are valued. Familiarize yourself with the "Four Cs" – color, clarity, cut, and carat weight – which play a significant role in determining a gemstone's quality and value.

- Research Market Trends: Stay informed about current trends and developments in the gemstone market. Follow industry news, attend gem shows, and read reputable publications to understand supply and demand dynamics, price fluctuations, and potential investment opportunities.

- Consider Rarity and Demand: Focus on gemstones that are rare and in high demand. Colored gemstones like emeralds, rubies, sapphires, and tanzanite are known for their investment potential due to their scarcity and enduring popularity among collectors and consumers.

- Verify Authenticity: Due diligence is crucial in gemstone investing. Only purchase gemstones from reputable and certified dealers who can provide documentation proving the authenticity and quality of the stones. Obtain gemstone certificates from recognized gemological laboratories for added assurance.

- Diversify Your Portfolio: Avoid concentrating all your investment funds into a single gemstone. Diversification can help mitigate risks and increase the likelihood of returns. Consider acquiring a diverse collection of gemstones in different types, sizes, and price ranges.

- Understand Gemstone Treatments: Be aware of gemstone treatments and enhancements that are commonly applied to improve their appearance. Some treatments are acceptable and do not significantly impact value, while others can significantly affect a gemstone's worth. Educate yourself on the different treatments and their implications for investment purposes.

- Seek Professional Advice: Engage the services of experienced gemologists, appraisers, or financial advisors with expertise in gemstone investing. They can provide valuable insights, guide you in making informed decisions, and help assess the quality and value of gemstones.

- Practice Patience and Long-Term Outlook: Gemstone investing is not a quick path to riches. It often requires a patient and long-term approach. Appreciation in gemstone value can take years, if not decades. Be prepared to hold your gemstone investments for extended periods to potentially reap the rewards of market growth.

Conclusion:

In conclusion, the allure of investing in colored gemstones shines bright as a lucrative opportunity for savvy investors seeking diversification and potential returns. Beyond their intrinsic beauty and historical significance, colored gemstones offer tangible assets that can act as a hedge against inflation and hold enduring appeal in the jewelry market.

As we explored the rich history of gemstones, it is evident that these precious stones have been cherished throughout the ages for their symbolism and enchanting allure. From ancient civilizations to modern times, gemstones have transcended cultural boundaries, serving as adornments, talismans, and symbols of power.

Today, gemstone investing presents an enticing prospect to enhance one's investment portfolio. The rarity and exclusivity of colored gemstones, coupled with their demand from emerging markets, underscore their potential for value appreciation over time. Moreover, the tangibility of these assets provides a unique advantage, allowing investors to physically enjoy and possess their investments.

However, like any investment, caution and careful consideration are paramount. Investors should educate themselves, stay informed about market trends, verify gemstone authenticity, and seek professional advice to make well-informed decisions. Patience and a long-term outlook are essential, as gemstone appreciation may unfold gradually, rewarding those with a steadfast commitment to this shimmering asset class.

As investors explore the world of colored gemstones, they embrace the sparkle of opportunity that these precious stones offer. With thorough research, expert guidance, and a passion for the beauty of gemstones, investors can find a brilliant path to diversify their portfolios and shine a light on the timeless allure of colored gemstone investments.

Leave a comment

Please note, comments need to be approved before they are published.